Quick facts

- Track inputs and labor for a few of your most important crops each season to discover profit margin or breakeven costs by crop.

- Choose a recordkeeping system that will work for you and that you will use.

- Record what, when, where and how much for any income or expense to accurately categorize and analyze your records.

Recordkeeping is essential for specialty crop farmers to best understand how to manage their operations. Financial recordkeeping such as recording and categorizing sales and expenses is like any other farm operation. But, due to the diversity of crops grown on their farms and the complexity of tracking labor, keeping production records can be challenging.

Financial records help you do taxes, but, more importantly, they can give you a clear idea of your business performance. The only way to accurately know your current financial position or last year’s profitability is to have accurate information.

No matter the type of financial record, the information you associate with each should answer the same important questions:

- When did this income or expense happen?

- Where did it come from?

- What is the sale or expense for?

- How much?

Expense records

What are your biggest costs? Where are places you should concentrate to control your costs and increase your profits? Expenses need to be categorized to make sense of your business and split into direct and overhead costs.

- Direct costs relate to production such as seed, fertilizer and fuel.

- Overhead costs relate to the business as a whole such as property taxes, depreciation and mortgage payments.

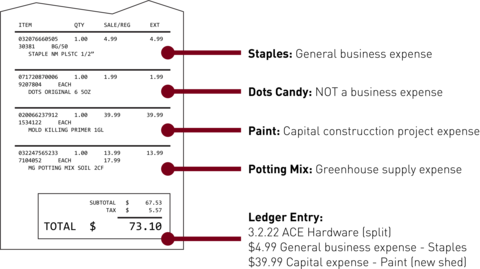

The most important part of expense recordkeeping is categorization. The amount your business spends with a particular vendor or supplier is not nearly as important as what the expense was for.

One simple piece of recordkeeping is to consistently put notes on receipts and denote expenses by categories.

Sales records

Which customers are your best? Should you focus more on farmers market sales or double down on your farm stand? Specialty crop operators often sell through multiple market channels and recording sales for each is important to understand how each market channel is performing.

An outlet is a single site or place where you sell, whereas a market channel is a set of similar outlets. For example, you may sell at three farmers markets, two restaurants, and through a summer CSA. Each farmers market is an outlet and all three farmers markets together are one market channel.

When you sell through many outlets and market channels, you will need to keep records by both outlet and market channel so you can analyze each. To do so, any sales records must be categorized by outlet.

Transactions by type can also complicate any sales records. Specialty crop operators can make a sale using payment apps, cash, checks and credit cards. Although not as important a factor as sale location, transaction type can be tracked to better understand the preferred means of customers in order to better streamline payments.

Production records

Labor is an important expense category due to the high labor inputs in specialty crops and also the reporting requirements associated with any labor expenses. Tracking the total time of hired labor is an obvious legal and ethical requirement for accurate payroll and payroll taxes.

Getting a handle on where you and your employees spend time by crop or business activity are details that may not be necessary, but can greatly assist your business management.

When growing upwards of 30 crops and many varieties, production records for specialty crops can become complex and difficult to implement well.

One common strategy of specialty crop operators is to track a few crops each season, keeping records on yield, input costs and time per crop. Even if you grow a crop across a wide area, focusing on costs and yields for a single area or bed to calculate the cost of production for the individual crop can make the process manageable.

- Yield: The difference in revenue is significant whether a 100-foot bed of beans produces 3 or 6 bushels. For total yield, you must record the total harvested from an area for its full production. In the case of beans, this may include two to three harvests with care taken only to include marketable produce. With an accurate yield, an operator can easily estimate total revenue, assigning prices or value to a crop.

- Input costs: These are variable costs used to grow the crop each season such as machinery use, plastic mulch, seed, and fertilizers. Operators can record the amount of input on the area during the season and rely on financial records to allocate costs proportionally to the area. For example, an operator would record that they spread 3 bags of compost when preparing a 100-foot bed and broadcast 4 pounds of fertilizer when side dressing the growing plants. When time allows to do analysis, the same operator can look up cost per bag and fertilizer cost from their financial record to calculate input costs.

- Labor costs: No doubt the greatest challenge of recordkeeping with specialty crops is tracking time. Operators and their employees can spend small bits of time across the life of a crop from bed preparation to post-harvest cleanup that are difficult to recall. For an accurate estimate of time per crop, an operator needs a consistent method to record time shortly after the task is done. Some operators use a Google form or other quick survey tool on their phones to log time, whereas others do an end-of-shift tally in a paper logbook.

Center for Farm Financial Management video: Introduction to Accounting & Record Keeping; https://ifsam.cffm.umn.edu/Module.aspx?v=2030

Reviewed in 2023