Farm finance

Get the 2024 Farm Resource Guide

The Farm Resource Guide for 2024 is now available at many local Extension offices. You also can download it for free.

This guide includes useful forms and farm business management information including:

- Custom rates: What to charge for planting, etc.

- Average farmland rental rates by county with projections for 2024.

- Flexible rental agreements and how they work. Lease forms for cash rent and share rent arrangements.

- Farmland sales information for all Minnesota counties.

- Charges for custom feeding, commodity storage, leasing buildings and bin rental rates.

- Pasture rental rates, tree timber values.

- Commodity price probabilities for corn, soybeans, alfalfa hay, straw, grass hay, hogs and cattle.

- Corn and soybean yields by county; used to calculate USDA farm bill payments.

- Feedlot rules for manure agreements and easements. Manure spreading lease examples and land application agreement forms.

Farm financial management

A complete set of financial statements for agriculture include: a balance sheet, an income statement, a statement of owner's equity and a statement of cash flows. Learn how to use these in your farm business.

Learn what a balance sheet is and how it can help you understand your financial situation.

-

A balance sheet lists assets, liabilities and net worth as of a certain date.

-

View an example balance sheet.

-

Learn what terms on a balance sheet meet--such as current, intermediate and long-term assets.

An income statement measures profit or loss in a given length of time. View an example income statement and learn more about income statements including:

-

Steps in creating an accrual adjusted income statement.

-

What you can learn from an income statement.

The statement of owner's equity is a financial statement that analyzes why a farmer’s net worth (or owner equity) changed over the past year.

The statement of owner's equity is divided into three groups, each examining an individual portion of a farm’s financial life: earnings, things that don’t happen every year, and changes in capital assets and deferred liabilities.

The statement of cash flows examines how cash has entered and left your financial life during the year.

-

Understand the difference between cash flow and net profit.

-

Create your own statement of cash flows to examine different sources and uses for cash.

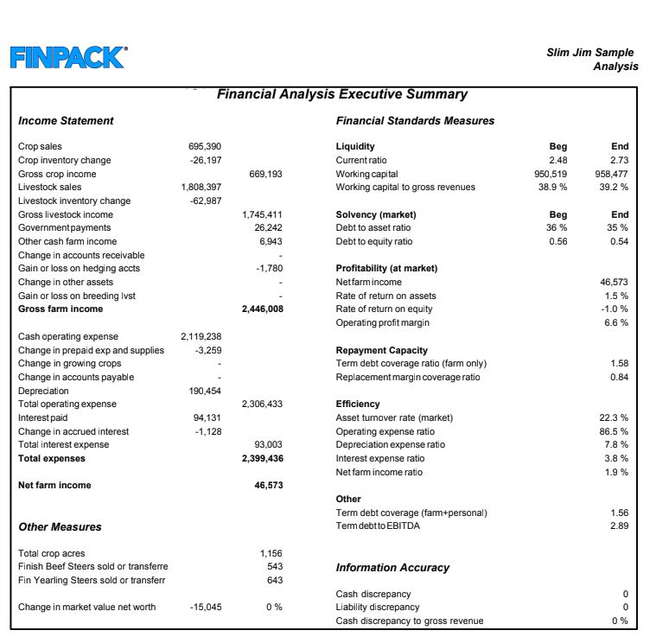

In the last few decades, much progress has been made to standardize financial statements in agriculture. This allows for ratios and measurements commonly used in other industries to become standard in the farmer’s financial world.

Key ratios and measurements covering liquidity, solvency, profitability, repayment capacity and efficiency have become standards in the agricultural industry and are generated from these financial statements.

-

Learn about different ways to measure liquidity, solvency, profitability, repayment capacity and efficiency.

-

Learn about different ratios including current ratio, debt to equity ratio and others.

Benchmarking is a process that makes it possible to research your farming business to find opportunities to improve your financial position, efficiency and profitability.

Learn more about how to interpret financial statements and measures.

The 2019 FINBIN report on Minnesota finances (PDF) includes information about the state of agriculture in Minnesota.

- Profitability

- Liquidity

- Solvency

- Debt repayment capacity

- Median net farm income including for crop and livestock farms

The 2,306 Minnesota farms included in the FINBIN database represent a broad cross-section of Minnesota production agriculture. FINBIN data is provided by farms that participate in Minnesota State Farm Business Management Education programs and the Southwestern Minnesota Farm Business Management Association.

Crop farm finance

- View 10-year average, past year actual, and this year's projected data of income and expenses in crop budgets for southern, central and northwestern Minnesota.

- Copy the acceptable crop price worksheet to your workspace to determine breakeven prices for your crops. You can also download a PDF version.

- View averages for Minnesota corn and soybean yields. Data includes the five-year averages for counties, regions and the state.

Prevented planting: Crop insurance and tax considerations — Options for farmers with federal crop insurance who have not been able to plant by a given crop's final planting date or have drowned out areas in fields.

What does it cost to own and operate farm machinery? Machinery costs are substantial; control of them is important.

- View document with machine costs separated into time-related and use-related categories.

- Download the Farm Machinery Economic Cost Estimation Spreadsheet (Contains macros. To make the macros operate properly, you will need to save the spreadsheet to your computer and open it. Click the "Enable content" button when prompted. Requires Excel 2007 or later.)

Regardless of the reasons you may be considering cover crops, you need to be able to pay for them and ideally get a return on your investment. This tool is designed to help farmers analyze the potential cash flow over multiple years associated with adding cover crops to your corn-soybean rotation. The tool provides both single-year analysis and a 5- and 10-year analysis.

- The decision tool assumes a corn-soybean rotation and analyzes a single field. It is not a whole-farm analysis.

- All costs are calculated on the per-acre level.

- On the “Field Information” tab of the spreadsheet, the calculations on the right portray the economic impact of cover crops in year 1 of establishment.

- The bottom of the worksheet calculates the multi-year economic impact, considering the net present value of both 5-year and 10-year spans.

- A detailed look at the multi-year analysis is on the final worksheet of the spreadsheet.

What’s behind the numbers?

Cash crop yield benefits due to the cover crop are calculated in the multi-year analysis according to the yield increases calculated by Sustainable Agriculture Research and Education (SARE). See SARE's analysis of the economics of cover crops.

Net present value is the sum of each year's cash flows, discounted by a 2.5% inflation rate to account for money's decreasing value over time.

This video series explains how to use the tool

Introduction to using the tool (video: 02:26)

Entering data (video: 07:22)

Decision tool examples (video: 11:46)

Download the UMN Cover Crop Multi-Year Economic Decision Tool.

Dairy farm finance

Get information on managing your dairy business.

- Managing margins

- Value-added opportunities

- Cost of production

- Robotics

Rural economy

Agritourism: where agriculture and tourism meet

COVID-19 and the rural economy

Reports on the effects of COVID-19 on livestock operations and the Minnesota economy.