An income statement measures profit or loss in a given length of time. In the case of farms, this length of time is usually one year. The year should be the same as the tax year.

Farmers who do not use an income statement often rely on the Schedule F from their tax return to measure their income. Since most farmers are on a cash basis for taxes, their Schedule F only shows the amount of cash sales less cash purchases and an allowance for depreciation.

Being on cash basis for income taxes is good, in that it gives you a lot of flexibility in controlling the amount of taxable income that you have for the year. However, the Schedule F is a poor tool to rely on to measure profitability. It measures the amount of cash that was handled, but gives no hint as to:

Whether only a portion of a crop was sold (or perhaps two crops were sold).

Whether all of the year’s bills were paid (or perhaps some of the previous year’s bills were also paid).

Whether all income earned was collected (or if it is still owed).

An accrual adjusted income statement combines the cash basis farm records with the inventories from the balance sheets (the beginning and end of the year) to give a true measure of profitability.

The income statement produced by the FINPACK software called FINAN is an accrual adjusted income statement. There are other accrual adjusted income statements that measure income in a similar way.

Creating an accrual adjusted income statement

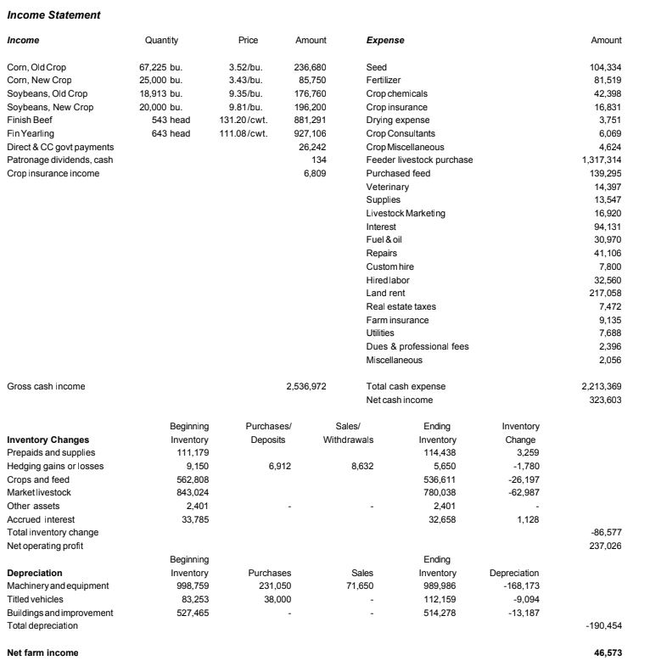

The cash farm income and the cash farm expenses are shown on the income statement. Each is totaled. The total cash farm expense is then subtracted from the cash farm income to get the net cash farm income. This is an accurate measure of the dollars of income and expenses that were handled during the year, but it does not yet measure profit.

The balance sheets from the beginning and end of the year lists the inventories of production assets and liabilities.

-

The values of the farm inventories at the beginning and end of the year, by category (crop and feed, market livestock, receivables and other income items, prepaid expenses and supplies, and payables and accrued expenses) are then shown on the income statement.

-

The increases or decreases are calculated.

-

The changes for each category are totaled.

-

This total inventory change is then combined with the net cash farm income to produce the farm’s net operating profit. This is the farm’s profit though it does not consider depreciation yet.

A depreciation and other capital adjustments expense is calculated. This depreciation could be your actual “tax” depreciation, or it could be the “book” depreciation based more on gradual and realistic wear and tear decrease in value over time.

The depreciation is then subtracted from the net operating profit to calculate the net farm income. This is your farm’s profit or loss. This net farm income, plus any non-farm income, is what is needed to provide for family living, payment of income taxes and the principal payment obligations.

Adequate net income is key to farm business survival

Net income must be sufficient to cover the living, taxes and principal payment of term debt. If the net income is not adequate to also cover these term debt principal payments, either they will:

Not get paid,

Will get paid, but will be borrowed elsewhere (perhaps on the operating loan), or

Will be paid from the liquidation of assets.

The existence of adequate net income is absolutely key to the survival of a farm business. How do you measure whether it exists? The accrual adjusted income statement. Without a good accrual adjusted income statement, how would you know if there was a profit?

What you can you learn from an income statement?

When we have a good income statement, ratios and measurements on profitability, repayment capacity and efficiency can be calculated. These ratios and measurements are just a few of the key financial measurements needed to understand the farm business’s financial health. In addition to an income statement, a balance sheet, a statement of owner's equity and a statement of cash flows are required to fully analyze the farm. Learn more about ratios and measurements.

Reviewed in 2023