The statement of owner's equity is a financial statement that analyzes why a farmer’s net worth (or owner equity) changed over the past year.

This change in net worth is caused by a number of factors such as

Earning money

Spending money

Paying taxes

Inheriting or receiving gifts

Giving gifts

Having debts forgiven

Having assets inflate or deflate in value

By simply comparing the net worth on the balance sheet from one year to another, you can tell whether it went up or down but not what caused the change. The statement of owner's equity shows what caused the change.

Creating a statement of owner's equity

To complete a statement of owner's equity, start with a good balance sheet from the beginning of the year, another for the end of the year and an accrual adjusted income statement for the year.

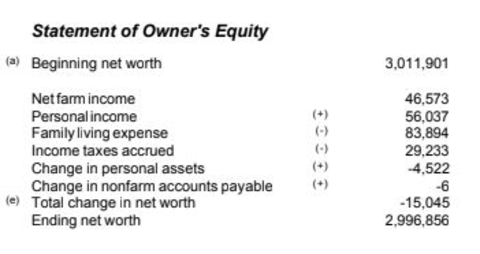

The net worth at the beginning of the year, taken from the balance sheet at the beginning of the year, is the starting figure for this statement of owner's equity.

The statement of owner's equity is divided into three groups, each examining an individual portion of a farm’s financial life:

1. Earnings

The first group deals with earnings.

It lists net farm income (profits, as measured by the income statement) and non-farm income (if any). These are the earned dollars from the year.

It then subtracts the amount spent for family living and taxes.

It then adjusts (+ or -) the changes in value of non-farm assets and the changes in the non-farm accounts payable.

These components are then added to produce the total change in retained earnings. This figure indicates whether more money was earned than what was consumed for personal use, and what was paid in taxes.

If the farmer and the family earned more than what was spent, the result is a positive figure that contributes to net worth. If they spent more than what was earned, the figure will be negative and will contribute to a decline in net worth.

2. Things that don’t happen every year

These items are totaled to produce total change in contributed capital.

Gifts and inheritances

Debts forgiven

Gifts given

If the total of gifts and inheritances received and debts forgiven exceeds the total of gifts given, then the total change in contributed capital will be a positive number, and it will contribute to the net worth increase. If it is a minus figure, it will contribute to the net worth decrease.

3. Changes in capital assets and deferred liabilities

The third group accounts for the change in market value of capital assets during the year, and the change in deferred liabilities from your balance sheet at the beginning of the year compared to balance sheet at the end of the year.

These items are totaled to produce the total change in market valuation. This figure either contributes to or has a negative effect on net worth depending on the market valuation changes and the resulting deferred tax liability change.

What you can you learn from a statement of owner's equity?

The change in retained earnings, the change in contributed capital and the change in market valuation are then totaled to produce the total change in net worth. This is the amount that the net worth increased or decreased from one year ago.

The total change in net worth is added to the beginning net worth to come up with the ending net worth. This ending net worth is the same as that on your year-end balance sheet.

Your net worth will change every year. Is it because you earned more money than was consumed and spent for taxes? Have you inherited or received gifts? How much of your net worth change was caused by inflation or deflation of your assets? These are answered by your statement of owner's equity.

Reviewed in 2018